In a recent blog post, Selecting the Right Payment Technology Partner for Your Software Business, we included a list of essential components to look for when choosing a payment technology partner.

One of those key pieces is a well-thought-out, comprehensive integration plan.

As with any endeavor, you need to know what is involved and what is needed before committing to that project and getting started.

So what’s involved in the gateway integration process at Constellation Payments?

Here’s an overview of the process and phases when integrating with our gateway — from “Kick-off” to “Go Live”:

1. Integration Guide

At Constellation Payments, we first provide a thorough Integration Guide, as well as online access to API information and guides that merchants and channel partners use for processing transactions, analyzing previous transactions, dealing with chargebacks and more. The Integration Guide clearly spells out API specifications and supported operations.

2. Kick-off Meeting

After necessary support documentation has been provided to the channel partner, the Constellation Payments Channel Partner Project Manager meets with your team to discuss use cases, integration types, the integration process and next steps. The meeting typically takes an hour.

If applicable, a demo of your current environment is requested to help define project scope and requirements.

3. Finalize Project Scope

The scope will be identified during the kickoff meeting. The next step is to complete an integration form to validate the integration strategy. The Constellation Payments Integration team will use the details from the form to build your test account in our test environment.

4. Test Environment Set-Up

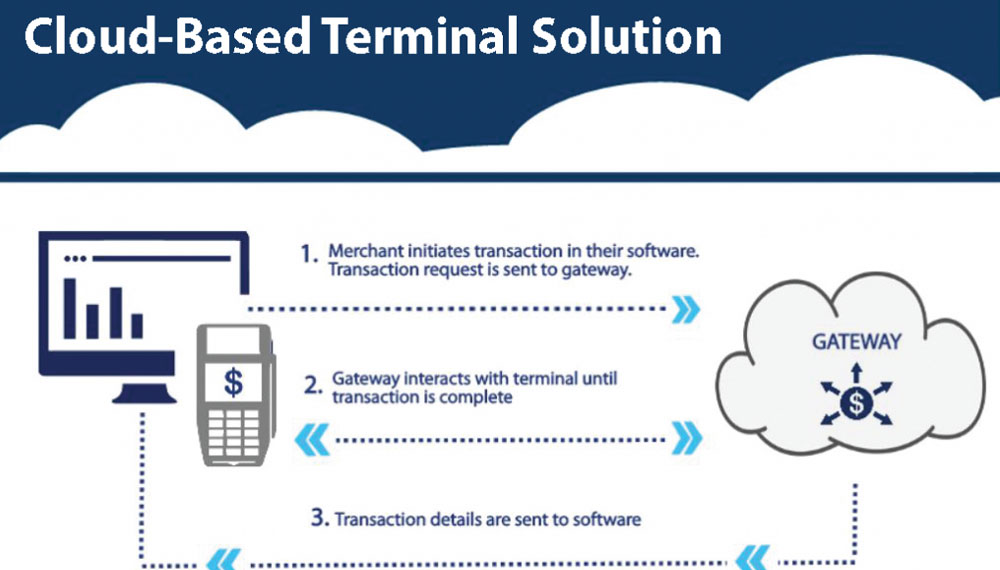

The next step is to confirm your test environment access with the account credentials provided. If your project includes terminal integration, you are asked to complete a Development Terminal Order Form.

5. Complete Development

A standard implementation is spread throughout a 4-week development phase. The Constellation Payments Integration team is available for any questions your team may have during your development. Also, during this time, there is a weekly development status meeting to review open issues and guide you through the completion of the development.

6. Perform Testing

A test plan is provided based on your implementation type (Real Time, Batch, Terminal). Testing includes transactions with various approvals and declines for each transaction type, card types and various payment options. The Constellation Payments Integration team will certify that your transactions contain the appropriate parameters.

This phase starts with a test kickoff meeting and includes weekly testing status.

7. Production Set-Up

At this point, the production environment is set up with access for your team. The Constellation Payments Channel Partner Project Manager will coordinate with the Constellation Payments Sales team for merchant onboarding.

8. Production Go Live

A production readiness review will confirm all testing and production set-up is complete to ensure you are ready to go live. Initial transactions will be monitored by the Constellation Payments Integration team.

At this point, you are integrated with Constellation Payments!

If you’re looking to integrate with Constellation Payments’ gateway, or have any implementation or gateway questions, feel free to contact us at 888.248.7060.

Get Our Best Advice Sent to Your Inbox!

Get Our Best Advice Sent to Your Inbox!

Connect with Constellation Payments

Connect with Constellation Payments