Understandably, one of the biggest concerns about the EMV changes that take effect here in the U.S. on October 1st is the impact of the merchant liability shift.

Right now, as it has been for the longest time, card issuers are the ones who bear the brunt of most credit card fraud.

Starting October 1st, this will change. Under certain conditions, card issuers are no longer going to cover a merchant’s risk associated with transactions that result in fraud.

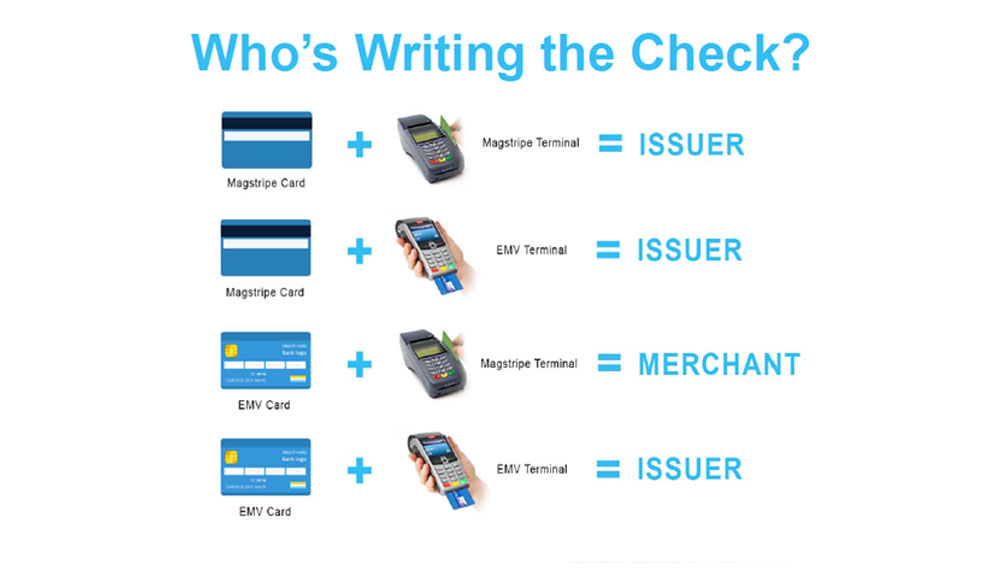

So what are those conditions? We’ve developed a simple chart to give you a concrete understanding of the different possible scenarios and how they will affect merchants that accept credit cards. Continue reading “EMV Merchant Liability Shift: Who Covers the Cost of Credit Card Fraud Starting October 1st?”