During this time, we understand that you may be experiencing unforeseen challenges at your business. We want you to know that Constellation Payments stands ready to support you, your staff, your customers, and your communities.

While we are taking every precaution to ensure the continued health and safety of our employees, we want you to know that we also have a tested business continuity plan in place to continue to serve your business and its payment processing needs without interruption.

With that in mind, here are a few important updates:

- Our staff is continuing to work normal business hours from secure remote locations. We are here to help and support you with keeping your business operational. Please don’t hesitate to reach out to us using the support channels listed below.

- If you are on the Constellation Payments gateway, you will continue to receive payments on time and at your chosen frequency. At this time, we have received no indication from our payment processing partners that there will be any interruptions in service.

- Online payment alternatives are available for your business. Amid the spread of COVID-19, many businesses are reconsidering how they handle cash, checks, and credit cards. Contactless and digital payments are being encouraged as alternative payment methods as they require less physical interaction and are more secure.

We can help with online payment alternatives such as deploying hosted payment pages to enable your customers to pay securely online by credit card, debit card, and ACH/EFT. Please contact your software provider or call our Product Support Team at 888.248.7060 to discuss alternative digital payment methods.

- An after-hours emergency support line is available for true technical emergencies. Should you experience a technical issue, first check the status page where we post about scheduled maintenance, downtime, incidents, outages, and resolutions.

If the issue is a true technical emergency occurring between the hours of 5 pm ET and 8 am ET Monday through Friday, or over the weekend, please call the emergency support line at 844.9.CSIPAY or send an email to emergency@csipay.com.

We’ll continue to send updates if needed as the situation evolves. In the meantime, please continue to use the standard support channels noted below, and please don’t hesitate to reach out to us.

Thank you and stay safe,

The Team at Constellation Payments

Support Lines

(Monday through Friday: 9 am – 7 pm ET)

Channel Partner Support: 888.248.7060

Merchant Services Support: 888.244.2160

The Support Hub

Enter tickets, indicate priority, make updates, track status, view your own tickets, or all tickets from your organization at the Support Hub.

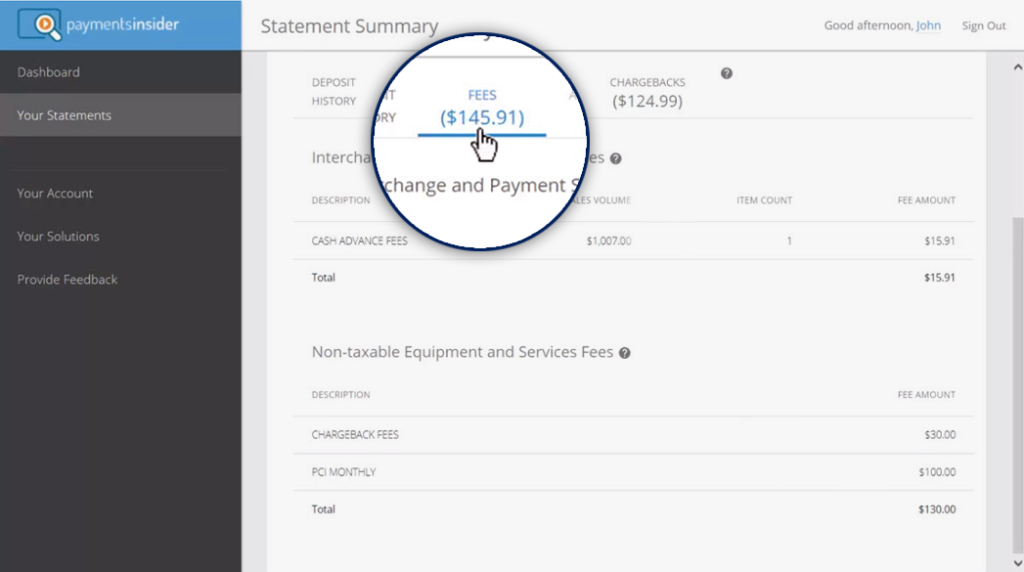

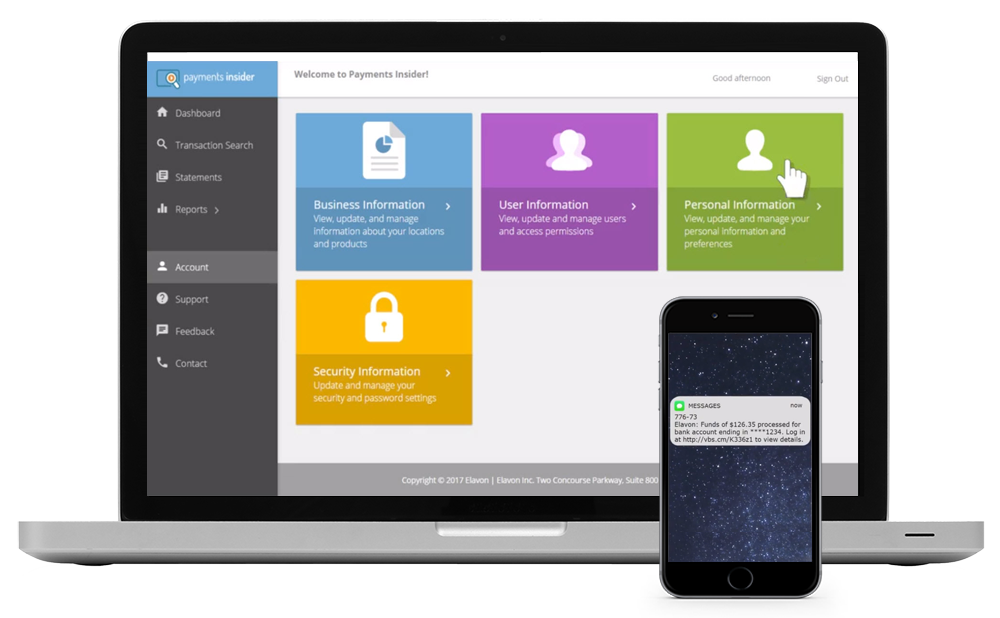

Payments Insider — Elavon’s Online Account Management Portal

Go to mypaymentsinsider.com, Elavon’s online account management portal, to manage your merchant account, get interactive statements, set up funding alerts, and access how-to videos.

If you don’t yet have a Payments Insider account, fill out the form here. A confirmation email will be sent to you with instructions to complete your account set-up.

Image by Free-Photos from Pixabay