Read through any payment trends list for the new year and you’re sure to find this: mobile payments will continue to rise throughout 2017.

It shouldn’t come as a surprise. Consumers go everywhere with their smartphones. It’s only logical that they’d use their mobile devices to pay on the go too.

What’s a Mobile Payment?

A mobile payment is the buying of products and services through wireless devices such as smartphones, tablets and smartwatches. Instead of paying with cash, check or credit cards, a consumer uses their mobile device to pay.

You can see mobile payments in action at many retail stores.

Take Starbucks® for instance. The majority of their loyal customers have the Starbucks® app on their Android or iPhone.

Each day, thousands of faithful patrons line up with their phone to pay for their coffee. The app is cleverly tied in to Starbucks® customer loyalty program, so app users collect stars and earn free drinks and food. The Starbucks® app is connected to the customer’s debit card or credit card, or a mobile payment app like Apple Pay.

Using the app to pay is quick … a customer taps a few buttons on the app, a bar code appears, the barista scans the phone with a reader. Done! There are endless opportunities for Constellation Payments software partners to utilize in-app payment processing. Gym owners could allow prospective members to purchase trial programs, or allow active members to purchase personal training sessions. Hotels could allow guests to book a spa appointment and pay right from the spa’s app.

But mobile payments don’t happen through apps alone. They also occur through mobile-optimized webpages. A few taps on your phone or tablet allows you to add products and services to your shopping cart, enter your payment info and complete purchases on the go.

What’s Spurring Mobile Payment Growth?

It’s important to know that digital wallet payments are becoming the norm – especially among millennials. People want their purchases to be quick and seamless wherever they go. Users are willingly switching to digital wallet payments because of the speed and convenience it provides compared to using traditional credit cards.

And, as we’ve seen with the advent of EMV in the U.S., consumers often times consider inserting a chip card into an EMV terminal to be more time-consuming. Plus, the majority of EMV terminals also support contactless payment methods like Apple Pay and Android Pay. That alone may propel consumers to move past using their chip cards and be more likely to pay with their mobile device.

How Business Owners Can Leverage the Growing Use of Mobile Payments

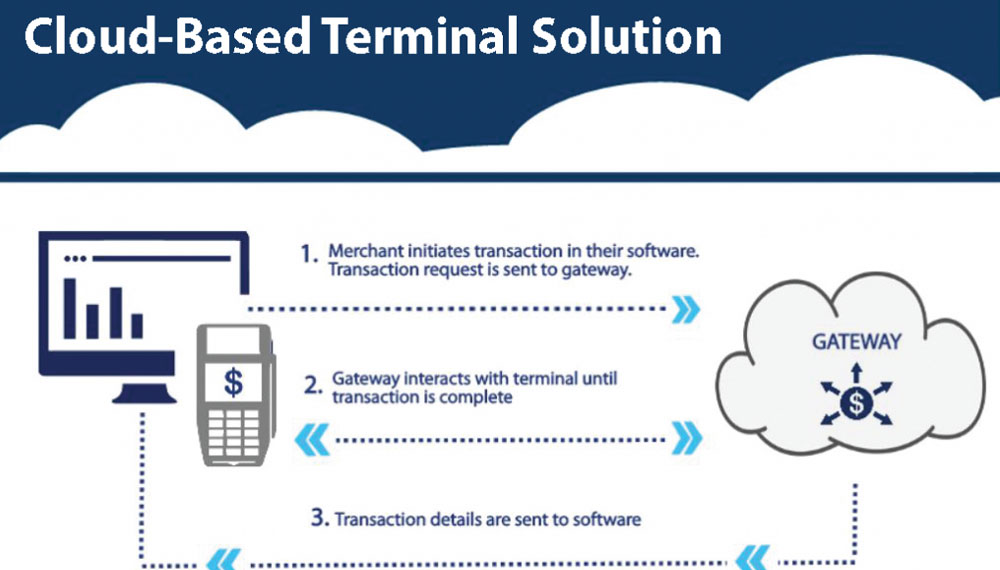

1. Contactless Payments

If you’re a Constellation Payments customer and use an integrated payment terminal, you’re set. Our integrated terminals have contactless payment functionality built in. Customers who have either an iPhone or Android phone can make purchases by holding their phone in close proximity to your terminal reader. Again, if you serve millennials, this functionality is key. It’s expected.

Note that your provider may need to activate your terminal’s contactless payments functionality for you depending on the software you use.

2. Mobile-Optimized Browser Payments

If you run an online store through your software or operate an ecommerce site, you’re going to want to make sure it’s mobile-optimized. That means going through the site and checkout process to make sure there are zero barriers to making a purchase – and that the transaction process is smooth, easy and secure.

3. In-App Payments

You may also want to consider an app for your business. Being able to not only take payments, but also perform key functions with a smartphone, like check in to a class or book an appointment, are becoming increasingly common.

At Constellation Payments, we have a module that can be used for in-app iOS transactions as a standalone or integrated solution via our API. Support for Android devices will be available April this year. In both cases, some development is required for any software company that wishes to use this functionality.

Giving Your Customers a Fast, Convenient Way to Pay

Now’s the time to embrace mobile payment technology. We can help. Our integrated payment terminals will give you immediate contactless payment functionality. Run an ecommerce site? We can build a mobile-optimized hosted payment page — enabling your business to sell online securely while taking your business out of PCI scope.

For additional guidance, send an email to sales@csipay.com or call us at 888.244.2160.

Second in-post image courtesy of Pixabay.

Get Our Best Advice Sent to Your Inbox!

Get Our Best Advice Sent to Your Inbox!

Connect with Constellation Payments

Connect with Constellation Payments