The year 2000. That’s when I moved out of my parents’ house, and into the real world.

I remember a big part of my adulting was setting aside an hour or so once a month to “pay the bills”. Paying the bills required my checkbook. (Not a real book, a small 3” x 6” — usually pleather — folder with a pad of paper checks and ledger inside.)

Paying the bills meant I’d write out each check, fill out the remittance slip, put the check and slip into the supplied return envelope, and slap a postage stamp on the envelope. I’d then take my stack of envelopes to the mailbox for the post office to pick up and deliver. Delivery would take anywhere from 1 to 3 days depending on the vendor location.

Quite a process.

Today, all my bills are paid electronically online as ACH payments. It takes about 10 minutes to pay all 6 of my bills. I haven’t yet made the jump to automatic ACH, but know many who have. Automatic ACH means no time at all is spent “paying the bills”.

What’s an ACH payment?

You’re probably familiar with ACH payments and don’t realize it.

Have you ever gone to pay a bill online and you’ve been prompted to enter your bank routing number and bank account number? That’s an ACH payment.

But let’s back-pedal a bit. That acronym. What’s it stand for? ACH is the Automated Clearing House — the clearing center for all electronic payments that happen between banks and financial institutions in the U.S.

When people talk about ACH they’re usually referring to ACH processing — the process of moving funds from one bank account to another. Or an ACH payment — an electronic payment/eCheck — where you, the customer, give authorization for an institution to debit funds directly from your checking or savings account for bill payment.

How does a business benefit from ACH?

The benefits of ACH payment are clear for consumers: It’s much more convenient. Making an ACH payment is a lot faster than writing out a check and getting the payment into the mail on time. Plus, money is saved by not having to buy postage stamps.

For a business, there are many benefits to taking ACH payments, too. Some of the top benefits are:

Faster processing time — With ACH payments, it’s all online, so the processing time is much faster which means you get your money quicker. ACH payments are usually processed within 1-2 business days versus 5-6 business days it takes for the check to arrive in the mail and process it.

Cost-effective — With ACH payments, the funds are transferred from bank account to bank account electronically which makes the transaction cost very low and therefore, a more cost-effective payment method for businesses than accepting credit and debit card payments.

Especially cost-effective for businesses and organizations with recurring billing — The more transactions you have, the more transaction fees you pay. And if you run a business that charges a monthly fee, like a gym, or have customers that pay on a recurring basis, like a utility company, you have lots of transactions. ACH is particularly attractive for these businesses and organizations because they can accept payments in a cost-effective way.

Think ACH is right for you?

Obviously, ACH offers both businesses and customers the opportunity to save time and it provides major convenience. For businesses, you’re able to secure payments faster and save on transaction fees with ACH.

If you’re interested in learning more about ACH, or signing up to take ACH payments, give us a call at 888.244.2160 or fill out our simple online form. We’d be happy to go over the rates for ACH with you and help you get set up so you can start saving and streamlining your payment process.

Kristen Campbell is the Brand Manager at Constellation Payments. She is responsible for managing all marketing initiatives and programs including channel partner and merchant success programs, public and media relations, internal and external communications, and customer engagement. You can reach Kristen by sending an email to kcampbell@csipay.com.

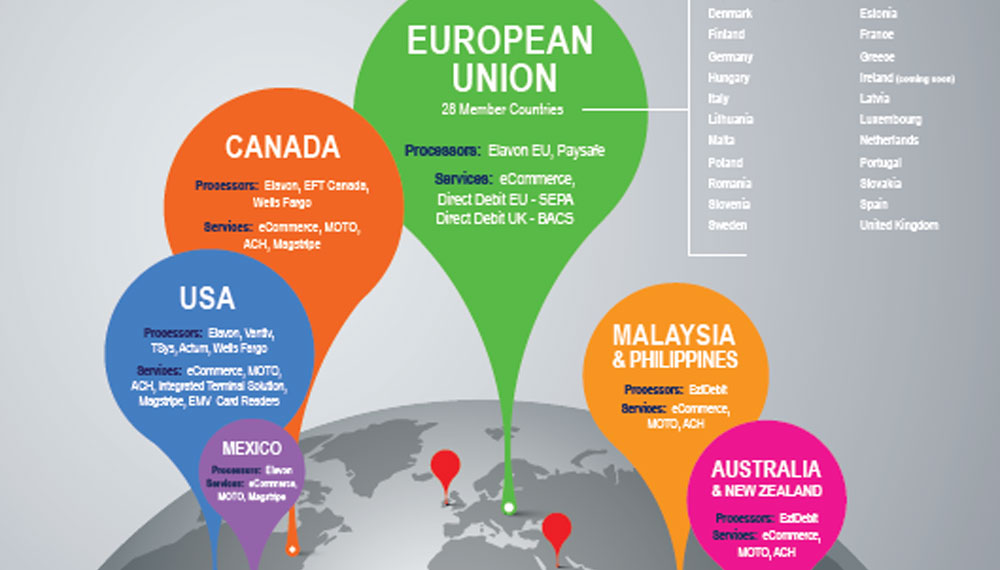

One challenge many companies encounter: very few payment gateways can facilitate payments in every country where they wish to expand their business. Without this ability, businesses wishing to acquire customers globally will face increased cost and reduced speed to market related to integration of their platform with several unique payment channels.

One challenge many companies encounter: very few payment gateways can facilitate payments in every country where they wish to expand their business. Without this ability, businesses wishing to acquire customers globally will face increased cost and reduced speed to market related to integration of their platform with several unique payment channels.